Work with mentally ill people long enough, and you will eventually find a patient who has become a “ward of the state”. A patient without any parent or family. In effect, the government is responsible for him. Hence, “ward of the state”.

That’s what all banks essentially are. Wards of the state.

Those who take ribā will not stand, except as one who stands as if driven crazy by Shaytan’s touch. That is because they have said: “Sale is but like ribā.’’, while Allah has permitted sale, and prohibited ribā. So, whoever receives an advice from his Lord and desists (from indulging in ribā), then what has passed is allowed for him, and his matter is up to Allah. As for the ones who revert back, those are the people of Fire. There they will remain forever.

Quite a fitting description for the bankers.

On that note, I noticed something quite bizarre. Not a single news outlet even tries to explain why Signature Bank crashed. Its been 72 hours since the bank failed. I couldn’t find a single good explanation. Maybe this pay-walled article gets points for effort?

Go ahead. Search Bloomberg or Wall Street Journal. You aren’t going to find anything. Just ambiguous drivel. Isn’t that unusual for the 3rd largest bank failure in American history to date?

One thing is for certain. The bank failed on Sunday, March 12. On the Friday before bankruptcy, depositors withdrew 20% of the bank's entire deposits. That's $17.8 billion withdrawal in one day.

Ask yourself. Why was there a bank run? Wasn’t everything going fine? Weren’t they expanding their workforce in January? Didn’t they increase their dividends by 25%?

Its clear that the bank wanted to give that image to the public. They wanted others to think they were successful. As they were increasing costs, and quietly losing money. As it turns out, some Signature executives were so convinced their scam would continue, they bought shares to keep the public image going. Three days later, the bank went bust.

Ahh, the traps of riba. Trying to impress others to keep the scam going.

Behind the riba curtain

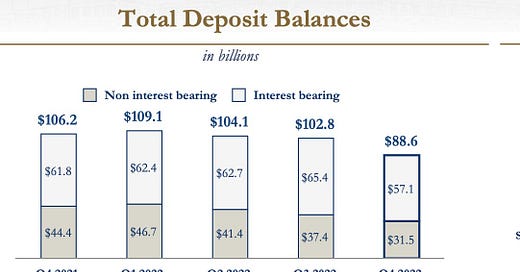

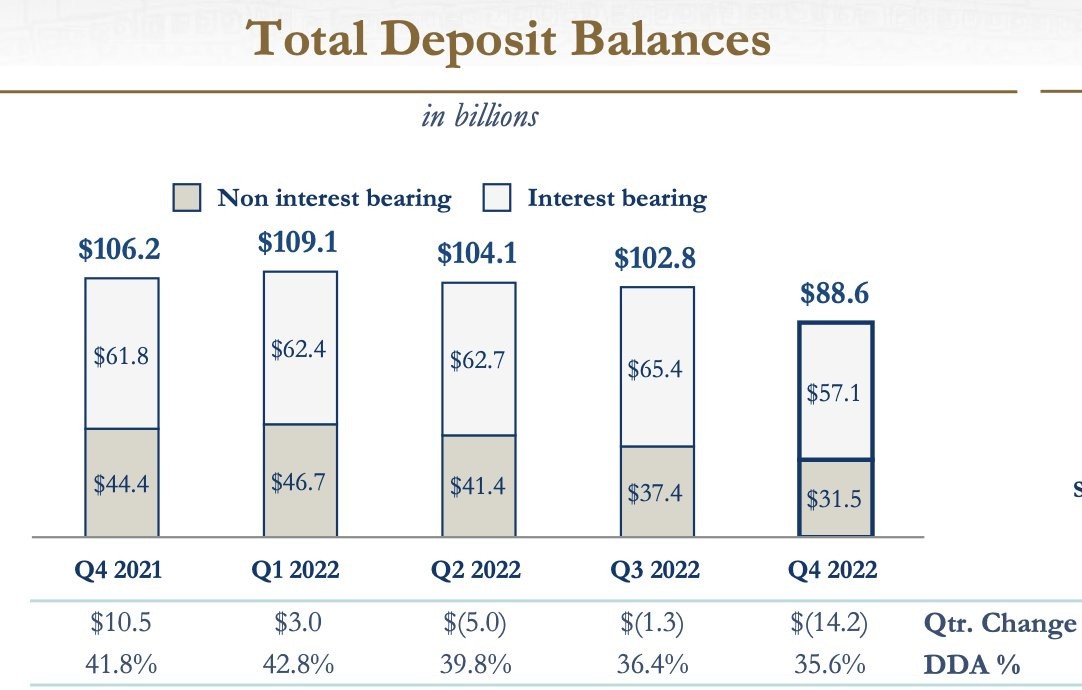

In reality, their deposits went down from $109 billion to $88 billion in a year! This bank was losing depositors.

Less depositors means it can lend less. And it has to sell assets at a loss to pay back the depositors. It was clear just by looking at the data, they were being squeezed.

So why was Signature Bank losing depositors so fast? Its growth was predicated on attracting crypto investors. Advertising itself as a bank that was a safe spot for people with cryptocurrency. In fact, 25% of the bank’s depositors were crypto investors. At the time of death, it was trying to bring that number down to 10%. It was an open secret. They talked about it in their last quarterly report.

Let’s say you are a drug lord with a lot of cryptocurrency. How are you going to convert that crypto to US dollars? You have a problem. Most banks don’t want anything to do with you. Who wants the FBI breathing down their neck? Reputations matter. And in banking, it can cause a bank run.

That’s where Signature Bank came in during crypto mania. It welcomed these crypto dealers. And as crypto lost value, the bank lost depositors. Signature didn’t have any loans backed by crypto. But it was reliant on crypto depositors. Who were bleeding when the bubble exploded.

Relationship with FTX

You might sob and say, “Oh, but you are spreading anti-crypto propaganda.” Well, go ahead look at SBNY client list yourself. Or take a look at Signature’s dubious history. Good grief, they had the Who’s Who of crypto fraud. Blockchain Terminal, FTX, Tether. Are you going to be surprised when the Department of Justice comes knocking?

That’s why an investment firm filed a class-action lawsuit against Signature a month ago. FTX had illegally used customer deposits to fund Alameda for years. And Signature Bank would move FTX money to Alameda. In effect, Signature was the payment server that allowed FTX to rob FTX’s depositors.

This wasn’t just irresponsible. It was decadent. FTX was able to rob so many people, because Signature processed those transfers. Not once. But for a number of years! At least from 2020 to 2022. Maybe longer.

The only question is… did Signature know that FTX was doing this? Does anyone in their right mind think that Signature was not aware? I’ll let the courts expose the obvious.

I do want to point out. Signature wasn’t invested in crypto. But it was processing crypto transactions. $1 trillion in processing for 1500 people in 2022. So, if Signature wasn’t invested in crypto… what was it invested in?

A terrible loan portfolio

Almost half the loan portfolio was in commercial real estate. In New York. Where office vacancies are spiraling out of control. Every dummy knows about work from home. Yet, Signature Bank chose to invest in real estate loans at the peak of the bubble. 44% of its loan portfolio is burning to the ground as we speak.

The other big chunk of its portfolio was for “fund banking”. A fancy word for venture capitalists putting money in stupid ideas. Most of these start-ups are deeply in debt. Most will fail. Some will rise from the ashes of this bubble. Reminiscent of Dot Com Crash.

Ouch!

Most misinformed people in America watch the news. What they don’t know is how numerous fake consultants are hired to pump scams. This is how pumping looks like. Didn’t Barron’s say Signature was a buy — only three days before it blew up? In fact, a Wall Street company — Piper Sandler — published a report saying "Signature's balance sheet was just fine". That was around an hour before it went bankrupt. Is it any secret that the most unintelligent people in your life watch mainstream news?

Signature had bad depositors and bad assets. No wonder there was a bank run. It might be more productive to ask, why wasn’t there a bank run sooner!

Rest is history. Like Silicon Valley Bank, it had 90% deposits that weren’t insured by the FDIC. $79 billion out of $89 billion deposits were not insured. Sadly, those depositors got the bailout, anyways.

I can promise you the world is a better place with another bank wiped out. Because Signature was one of the biggest lenders to NY landlords, these landlords lost an ally. They lost access to easy money. Its only a matter of time when the office landlords get squeezed too. I can’t wait to see them forced to sell for losses.

Might be relevant to note that the term “too big to fail” emerged in 1984 after Continent Illinois bank crashed in 1984. It was bailed out by the Federal Reserve. But I disagree with the concept. No bank is too big to fail. We need a reckoning.

This is part of my series on Interest Free Zone: All of the Sahih hadith related to riba, A study of weak hadith on riba, Defining riba, A detailed breakdown on why Islamic mortgages are backdoor riba, Do credit card rewards programs have riba?, Madness on options riba

Related, I have a Riba and Ruin series: Economics is to keep you a dummy, What happened to SVB?, Ward of the State, First Republic: A tale of a fake bank & a fake auction, Hush, hush, a small bank goes poof

Related, I have a Selling Islam series: Salaried Shaykhs, Can paid Shaykhs make mistakes?

References

Bradham, B. (2023, March 9). Signature bank sinks, but Piper says it's not another Silvergate. Bloomberg Law. https://news.bloomberglaw.com/crypto/signature-bank-sinks-but-piper-says-its-not-another-silvergate

Burnson, R. (2023, February 7). Signature bank accused in lawsuit of overlooking FTX fraud. Bloomberg. https://www.bloomberg.com/news/articles/2023-02-07/signature-bank-accused-in-lawsuit-of-overlooking-ftx-fraud

Cornfield, G. (2023). US office sales and prices keep falling with declining demand and ongoing distress. Commercial Observer. https://commercialobserver.com/2023/02/us-office-sales-values-distress/

Denton, J. (2023, January 17). Signature Bank closes 2022 with record profit even as cypto deposits plunge by $12 billion. Barron’s. https://www.barrons.com/articles/signature-bank-earnings-crypto-deposits-51673954963

Liu, E. (2023, March 15). The FDIC may need to do some juggling to pay off depositors. Barron's. https://www.barrons.com/articles/fdic-bank-insurance-depositors-f7261227

Reyes, M. (2023, March 14). Signature was seized after leaders caused crisis of confidence. Bloomberg. https://www.bloomberg.com/news/articles/2023-03-14/signature-was-seized-after-leaders-caused-crisis-of-confidence

Roberts, L. (2022, February 22). Bank Runs: The first sign the Fed broke something. Real Investment Advice. https://realinvestmentadvice.com/bank-runs-the-first-sign-the-fed-broke-something/

Root, A. (2023, March 13). Why signature bank failed. Barron's. https://www.barrons.com/articles/signature-bank-shut-down-collapse-a0adf63f

Tkacik, M. (2023, March 23). The Rich Bank, the Dumb Bank, and the Signature Requirement. The American Prospect. https://prospect.org/economy/2023-03-23-rich-bank-dumb-bank-signature/